Western Union stops sending money to Cuba following new U.S. financial measures

The money transfer giant's halt on sending money to Cuba, prompted by United States sanctions on entities linked to the Cuban government, has left families struggling. The suspension has disrupted a critical financial lifeline for many.

The recent interruption of cash transfers by the international remittance service has caused numerous families to seek alternative methods for sending financial aid. This decision follows new American sanctions targeting entities linked to the island’s government, restricting financial transactions.

With the services of this leading remittance network no longer available, Cuban families and their relatives abroad are being forced to explore other, often costlier, methods to send funds. These sanctions aim to pressure the Cuban authorities, but they are also creating significant challenges for citizens dependent on these payments.

Why did Western Union suspend transfers to Cuba and how are families impacted?

The global financial service halted operations to Cuba due to new United States led sanctions targeting entities linked to the island’s leadership. These measures aim to restrict funds that could support the regime, increasing economic pressure on the country.

For many families, financial support from relatives abroad is crucial. With the suspension of this system, they are now forced to find alternative, often more expensive, methods to send money, resulting in significant financial challenges.

Why are relatives affected by the suspension and what are their options?

For many families, financial support from loved ones abroad is crucial to meet daily needs. The suspension of transfers forces them to find alternative methods, often at higher costs and reduced security. As a result, many are now struggling to maintain the essential financial support necessary for their survival.

The loss of a trusted financial network has led many to explore informal channels, digital platforms, and other costly methods. While some options exist, they often come with risks and uncertainties, further complicating an already challenging economic situation for those affected.

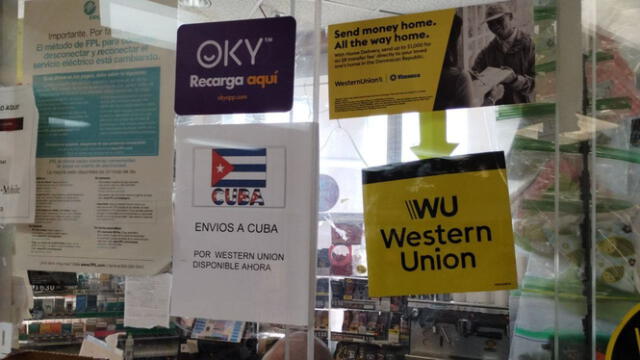

With transfers to Cuba suspended, Western Union offices face uncertainty. Photo: Ciber Cuba

What alternatives exist and how might the situation evolve?

With the halt of remittances, families are increasingly turning to other options, such as digital platforms and cryptocurrency, to send support. While these alternatives may offer some solutions, they often come with added fees, slower processing times, and potential security risks.

Experts suggest that as the situation develops, new financial solutions may emerge, but it remains uncertain how accessible or reliable they will be. In the meantime, those affected continue to search for secure and affordable methods to maintain vital assistance for their relatives overseas.